Bharat Personal Loan emerges as a noteworthy player in the digital lending landscape. This comprehensive Bharat personal loan review aims to provide valuable insights into Bharat Personal Loan, helping you make an informed decision about your borrowing needs in 2023.

As you journey through this review, you’ll uncover essential information, pros and cons, user experiences, and insights that will empower you to decide whether Bharat Personal Loan is the right fit for your financial aspirations in 2023.

Disclaimer:

This article is for informational purposes only and should not be construed as financial advice. The information contained in this article is based on the author’s own research and experience and may not apply to all borrowers. It is important to consult with a financial advisor before deciding on a personal loan.

We aim to equip you with the knowledge needed to navigate the complexities of personal finance and embark on a journey toward your financial goals with confidence and clarity. So, without further ado, let’s explore Bharat Personal Loan in 2023 and discover how it can be your partner in achieving financial milestones.

About Bharat Personal Loan

Bharat Personal Loan is India’s relatively new but promising digital lending platform. Established in 2021, it has quickly earned a reputation for reliability and trustworthiness. This platform primarily offers unsecured personal loans, catering to the diverse financial needs of individuals nationwide.

Bharat Personal Loan Amount and Tenure

Bharat Personal Loan offers up to ₹50,000 loans for those seeking financial assistance. Borrowers can choose from flexible repayment tenures of 6, 9, or 12 months, making it adaptable to various financial situations.

Bharat Personal Loan Review – Documents Required

To be eligible for a Bharat Personal Loan, you’ll need to fulfill some basic criteria:

- Residency in India

- Age over 18 years

- Valid PAN card and Aadhaar card

- Minimum monthly income of ₹10,000

Bharat Personal Loan Review – Pros and Cons

When considering any financial product or service, carefully weighing the pros and cons is essential. As a digital lending platform, Bharat Personal Loan has advantages and limitations. In this section, we’ll delve into the key pros and cons of Bharat Personal Loan to help you make an informed decision.

Also, Read – InCred Finance: Pros, Cons, and Everything You Need to Know

Pros of Bharat Personal Loan

1) Streamlined Application Process

One of Bharat Personal Loan’s standout features is its user-friendly and efficient application process. Borrowers can easily apply for a loan through the platform’s website or mobile app. The interface is intuitive, making it accessible even to those with limited technical expertise. This simplicity ensures you can complete your loan application swiftly, reducing unnecessary hassles.

2) Competitive Interest Rates

Bharat Personal Loan offers competitive interest rates, which can be a significant advantage for borrowers. Lower interest rates mean that you’ll pay less in interest charges over the life of your loan, helping you save money in the long run. It makes the platform an attractive option for those who want to access credit without incurring excessively high costs.

3) Responsive Customer Service

Customer service plays a vital role in the lending experience, and Bharat Personal Loan excels. They have garnered positive feedback for their attentive and responsive customer support team. Should you encounter any issues or have questions regarding your loan, you can expect prompt assistance, which can be invaluable during your borrowing journey.

4) No Collateral Required

Bharat Personal Loan offers unsecured personal loans, meaning you won’t have to pledge any collateral to secure your loan. This is especially beneficial for those who may not have valuable assets to offer as security. It reduces the risk associated with borrowing and provides accessibility to a broader range of borrowers.

5) Flexible Repayment Terms

The platform offers flexibility when it comes to loan repayment. You can choose from multiple tenure options, including 6, 9, or 12 months. This flexibility allows you to tailor your repayment schedule to your financial capacity, ensuring you can manage your loan comfortably.

Cons of Bharat Personal Loan

1) Relatively New Company

Bharat Personal Loan, established in 2021, is a relatively new entrant in the digital lending space. While it has gained trust and positive reviews, the lack of an extensive track record might make some borrowers cautious. Newer companies may not have faced the same range of economic conditions or challenges as more established lenders.

2) Limited Loan Amount

Bharat Personal Loan offers up to ₹50,000 loans. While this amount may suffice for many short-term financial needs, it may not meet larger borrowing requirements. If you require a substantial loan, you might need to explore other options to accommodate higher loan amounts.

Bharat Personal Loan is a viable option for individuals seeking a quick and convenient way to access personal loans. Its streamlined application process, competitive interest rates, responsive customer service, and flexibility in repayment terms are notable advantages. However, being a relatively new company and offering limited loan amounts are aspects to consider.

As with any financial decision, assessing your unique needs and circumstances is crucial before opting for a Bharat Personal Loan or any other lending platform.

Who Should Apply for a Bharat Personal Loan?

Bharat Personal Loan, as reviewed comprehensively in our earlier sections, is a versatile digital lending platform tailored to meet various financial needs. Let’s delve deeper into who should consider applying for a Bharat Personal Loan, considering its strengths and attributes.

1. Individuals Facing Financial Emergencies

Bharat Personal Loan can be a lifeline for those confronted with unexpected financial crises, such as medical expenses or urgent home repairs. The platform’s streamlined application process ensures swift access to funds during emergencies.

2. Borrowers with Short-Term Financial Requirements

If you have short-term financial objectives like financing education expenses, planning a vacation, or hosting a family event, Bharat Personal Loan offers the flexibility and convenience to fulfill these goals.

3. Small Business Owners and Entrepreneurs

Entrepreneurs often encounter fluctuating cash flows and immediate business opportunities. Thanks to its quick and hassle-free application process, Bharat Personal Loan can be a handy tool to manage cash flow gaps or seize time-sensitive business prospects.

4. Individuals without Collateral

Bharat Personal Loan’s appeal lies in its unsecured nature. It’s a suitable choice for individuals who lack substantial assets to use as collateral, eliminating the need for asset pledging.

5. Tech-Savvy Borrowers

Bharat Personal Loan operates entirely digitally, making it ideal for those comfortable with online transactions and mobile app usage. Tech-savvy individuals seeking a seamless digital lending experience will find this platform aligning with their preferences.

6. Borrowers Needing Smaller Loan Amounts

With a maximum loan amount of ₹50,000, Bharat Personal Loan caters to borrowers with modest financial requirements. This platform offers a straightforward solution if you want to bridge relatively small financial gaps.

7. Individuals Prioritizing Competitive Interest Rates

Bharat Personal Loan distinguishes itself with competitive interest rates. Lower interest rates can translate into substantial savings for borrowers who aim to minimize the overall cost of borrowing.

8. Borrowers Seeking Repayment Flexibility

The platform’s multiple repayment tenure options (6, 9, or 12 months) accommodate borrowers who value flexibility in structuring their loan repayments.

Bharat Personal Loan Review – Streamlined Application Process

In this segment of our Bharat Personal Loan Review, we look at the application process, a pivotal aspect of any lending platform. Bharat Personal Loan stands out for its user-friendly and straightforward loan application approach.

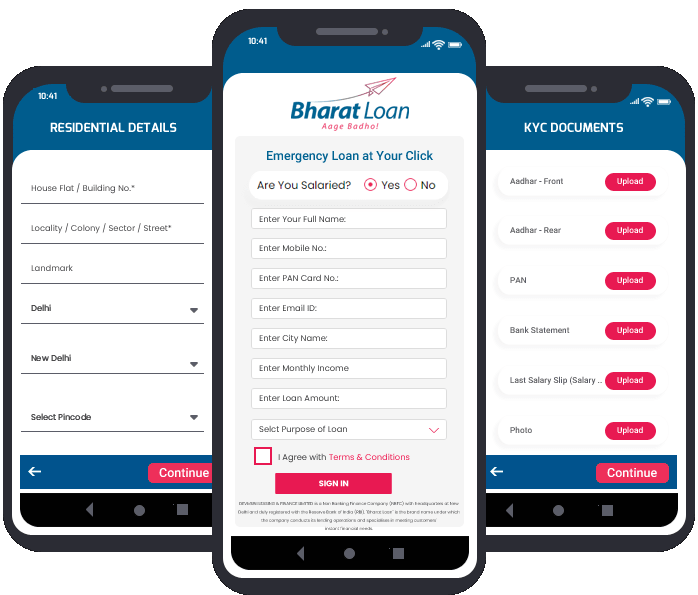

Application Channels – Bharat Personal Loan Review

Bharat Personal Loan recognizes the importance of accessibility and convenience. As highlighted in our Bharat Personal Loan Review, applicants have the flexibility to choose between two primary channels for initiating their loan application:

Website: Borrowers can access the loan application portal through the official Bharat Personal Loan website. The online interface is designed to be intuitive, ensuring that applicants can easily navigate the process. This channel allows you to complete the application from the comfort of your preferred device.

Mobile App: The Bharat Personal Loan mobile app, as discussed in our Bharat Personal Loan Review, caters to individuals who prefer the mobility and accessibility of a smartphone application. The app is designed to provide a seamless and efficient application experience, making it a convenient option for on-the-go borrowers.

Review and Approval – Bharat Personal Loan Review

Once your loan application is submitted through either of these channels, the Bharat Personal Loan team initiates a comprehensive review process. This review encompasses two crucial elements:

Application Evaluation: Bharat Personal Loan thoroughly assesses the information provided in your application. This includes verifying your personal details, income, and other relevant data. This meticulous evaluation is a vital step in ensuring responsible lending practices.

Credit Score Assessment: As a responsible lender, Bharat Personal Loan considers your creditworthiness. This involves checking your credit score, a key indicator of your financial reliability. While the platform accommodates borrowers with various credit profiles, a credit check is standard.

Speedy Disbursement – Bharat Personal Loan Review

One of the standout features of Bharat Personal Loan, as emphasized in our Bharat Personal Loan Review, is the rapid disbursement of approved loan amounts. If your application meets the criteria and is approved, the loan amount is swiftly disbursed into your designated bank account. This efficient disbursement process aims to ensure that you receive the funds you need in a timely manner.

The application process, from submission to disbursement, is designed to be expedient and hassle-free, aligning with Bharat Personal Loan’s commitment to providing accessible financial solutions. It’s important to note that the exact processing times may vary based on individual circumstances and the volume of applications received.

How to Secure a Bharat Personal Loan: A Step-by-Step Guide

Whether you apply through the website or the mobile app, you can expect a thorough yet swift evaluation of your application and, if approved, the timely disbursement of funds to address your financial needs. Let us look at the step-by-step guide to Bharat personal loans.

- Download the Bharat Personal Loan app or visit the website.

- Complete the application form with accurate information.

- Submit the required documents, including PAN and Aadhaar cards.

- Wait for the application to be reviewed and processed.

- Once approved, the loan amount is transferred to your bank account.

Is Bharat Personal Loan a Secure Lending Platform?

One of the paramount concerns when considering any digital lending platform is safety and reliability. In this section of our Bharat Personal Loan Review, we scrutinize the platform’s safety and trustworthiness to help you make an informed decision.

1) Customer Reviews and Ratings

One of the most telling indicators of a platform’s safety and customer satisfaction is the feedback from its users. Bharat Personal Loan has received acclaim from customers, as evidenced by our Bharat Personal Loan Review. It currently boasts an impressive 4.5-star rating on the Google Play Store, based on the feedback of over 500 reviews.

2) Swift and Hassle-Free Application Process

Customer testimonials consistently highlight Bharat Personal Loan’s seamless and expedient application process. The platform’s commitment to user-friendliness and efficiency, as outlined in our Bharat Personal Loan Review, is reflected in the positive experiences shared by borrowers. The convenience of the application process contributes to the overall sense of security and trustworthiness.

3) Competitive Interest Rates

In the financial landscape, competitive interest rates are a hallmark of a reliable lending platform. Bharat Personal Loan, as reviewed, offers interest rates that appeal to borrowers seeking affordability. Lower interest rates mean borrowers can reduce their overall borrowing costs, adding to the platform’s reputation for trustworthiness.

4) Outstanding Customer Service

A vital aspect of any lending institution’s trustworthiness is its customer service. Bharat Personal Loan shines in this regard, as evidenced in our Bharat Personal Loan Review. Customers consistently praise the platform’s responsive and attentive customer support team. In times of need or when questions arise, the availability of reliable assistance contributes to the overall sense of security.

Scam Free Loan Ratings – Bharat Personal Loan Review

Bharat Personal Loan’s reputation for reliability and trustworthiness is an encouraging sign. With no concerns yet reported, it appears to be a secure lending platform. Here are our ratings based on various criteria such as credibility, interest rates, and other factors.

Conclusion

In the ever-evolving world of digital lending, Bharat Personal Loan stands out as a promising option. While it’s a relatively new player in the field, its competitive interest rates, user-friendly application process, and positive customer reviews make it a viable choice for those needing a quick and hassle-free personal loan in 2023.

Bharat Personal Loan, as discussed in our Bharat Personal Loan Review, has garnered positive feedback from users, demonstrating its reliability and trustworthiness. The platform stands as a secure lending option with a high customer rating on the Google Play Store, a streamlined application process, competitive interest rates, and excellent customer service. However, as with any financial decision, it’s advisable to conduct thorough research, read the terms and conditions, and ensure that the platform aligns with your specific financial needs and goals before proceeding with a loan application.

However, borrowers should always exercise caution, compare terms, and thoroughly read the terms and conditions before committing to any loan, including Bharat Personal Loan.