In today’s world, managing finances can sometimes become overwhelming, especially when dealing with various debts. This is where a debt consolidation loan comes into play as a practical solution to help individuals regain control of their financial situation. Debt Consolidation Loan is the fastest personal loan you can get and pay off all your dues on time to safeguard your daily lifestyle. In this article, we’ll delve into what a debt consolidation loan is, how it works, its advantages, potential risks, and how to decide whether it’s the right choice for you.

What is Debt Consolidation?

Debt consolidation is taking out a new loan, often at a lower interest rate, to pay off multiple debts. This leaves you with a single monthly payment, simplifying your financial life and potentially reducing your overall interest costs. Several consolidation methods include personal loans, home equity loans, balance transfer credit cards, and debt management plans through credit counseling agencies.

Understanding Debt Consolidation Loan

A debt consolidation loan is like a financial “helping hand” that combines all your smaller debts into one larger loan. Instead of dealing with many different debts and monthly payments, you get one big loan to pay off everything. Then, you just have to make one monthly payment for that single loan.

Imagine you owe money on credit cards, medical bills, and a personal loan. With debt consolidation, you’d take out a new loan big enough to pay off all those debts. Now, you have just one loan and one monthly payment to remember.

This can make your financial life simpler and more manageable. You could save money in the long run if you find a consolidation loan with a lower interest rate.

So, in a nutshell, a debt consolidation loan combines your various debts into one, potentially making it easier to manage and more cost-effective.

How Does Debt Consolidation Work?

When you secure a debt consolidation loan, a lender provides you with a lump sum. You use this sum to pay off your existing debts. Once these obligations are settled, you have just one monthly payment to the lender. This streamlines the process, making it easier to keep track of your finances.

Think of debt consolidation as a financial puzzle solver. Dealing with different debts can feel like having many puzzle pieces scattered around. Debt consolidation puts these pieces together to form a clear picture.

Here’s how it works:

The Debt Collection: You start with various debts, like credit card balances, medical bills, or personal loans. These are like puzzle pieces that don’t quite fit together.

The Consolidation Loan: Now, you go to a bank or lender and get a special “debt consolidation loan.” This loan is like the magic glue that holds all the pieces together.

Paying Off Debts: With the consolidation loan, you use the money to pay off all your scattered debts. It’s like taking those puzzle pieces and making them disappear individually.

One Monthly Payment: After the loan pays off your debts, you’re left with just one thing to handle—the debt consolidation loan. This means only one monthly payment instead of many. It’s like putting all your puzzle pieces into one clear picture.

Lower Interest (Sometimes): If you find a consolidation loan with a lower interest rate than your old debts, you might save money over time. It’s like getting a discount on the glue that holds your puzzle together.

So, debt consolidation is like organizing your financial puzzle into one neat picture with fewer pieces to keep track of. It simplifies things and can save you money if you find the right glue (loan) for your puzzle.

Benefits of Debt Consolidation Loan

Debt consolidation offers several advantages. First, it can potentially lower your interest rate, helping you save money over time. Second, it reduces the complexity of managing multiple debts, simplifying your finances with just one monthly payment.

Additionally, timely payments on a consolidation loan can improve credit scores, making it easier to secure favorable loan terms in the future. There are several advantages to consolidating your debts; let us dive deep into various benefits of Deb Consolidation Loan

Lower Interest Rates: Debt consolidation loans often offer lower interest rates than credit cards or other high-interest debts. This can translate into long-term savings.

Reduced Monthly Payment: By consolidating, you can lower your monthly payment, making it more manageable and reducing financial stress.

Convenience: Managing a single monthly payment is more straightforward than juggling multiple due dates and amounts, making it easier to stay on top of your finances.

Potential Credit Score Improvement: Timely payments on a consolidation loan can positively impact your credit score, making obtaining favorable terms on future loans easier.

Read More – KreditBee Honest Loan Review: Pros, Cons, and Benefits

Risks Associated with Debt Consolidation Loan

While debt consolidation has benefits, being aware of potential risks is essential. One drawback is the possibility of a longer repayment term, which means you might pay more interest overall. Also, some consolidation loans come with extra fees, such as origination fees or prepayment penalties, which can increase the total cost.

If you don’t use the consolidation loan to pay off existing debts and instead accumulate new expenses, you risk falling into a cycle of perpetual debt without making progress. It’s crucial to weigh these risks carefully before opting for debt consolidation. However, it’s essential to consider potential drawbacks:

Extended Repayment Period: Consolidation loans may have longer repayment terms than your existing debts, which can mean paying more interest over time.

Additional Fees: Be mindful of potential fees like origination fees or prepayment penalties, which can add to the overall cost of the loan.

Debt Trap: If you don’t use the consolidation loan to pay off your debts but instead use it for new expenses, you may accumulate more debt without progressing.

Choosing a Debt Consolidation Loan

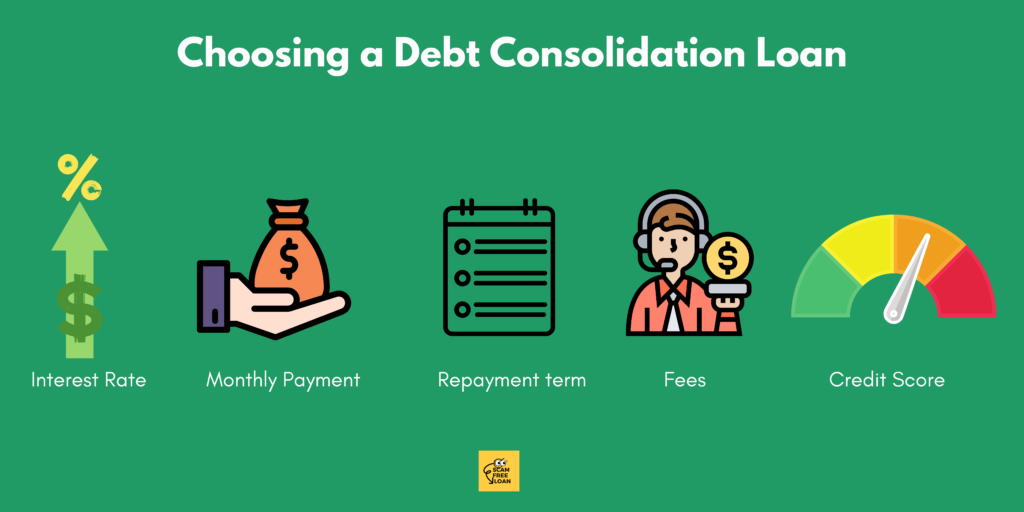

Debt consolidation can be a good option for those struggling to manage their debt. However, weighing the pros and cons carefully before taking out a debt consolidation loan is important. If you consider debt consolidation, speaking with a financial advisor to get personalized advice is important. When selecting a debt consolidation loan, consider these factors:

Interest rate: The interest rate is the most important factor to consider. The lower the interest rate, the less you will pay in interest over the life of the loan.

Monthly payment: Make sure you can afford the monthly payment. The monthly payment should be comfortable for you and not strain your budget.

Repayment term: Choose a repayment term that you can comfortably afford. The longer the repayment term, the lower your monthly payment will be, but you will pay more interest overall.

Fees: Be aware of any additional fees associated with the loan. Some lenders charge origination fees, prepayment penalties, or late payment fees.

Credit score: Your credit score will affect the interest rate you are offered. A good credit score will help you get approved for a debt consolidation loan with a lower interest rate.

Here are some additional tips for choosing a debt consolidation loan:

- Get pre-approved for a loan from multiple lenders. This will give you an idea of your options and the best interest rate you can qualify for.

- Compare loans based on the APR, including the interest rate and fees.

- Look for a loan with a fixed interest rate so you know how much you will pay each month.

- Choose a loan with a repayment term that you can comfortably afford.

- Ensure you understand all of the loan terms before you sign it.

Is Debt Consolidation Right for You?

Debt consolidation can be a powerful tool for individuals seeking to simplify their finances and reduce the burden of high-interest debt. However, it is essential to evaluate your specific financial situation and determine if it aligns with your goals and resources. To determine if debt consolidation is the right choice for you, consider the following factors:

High-Interest Debt

Debt consolidation is most beneficial when you have high-interest debts, such as credit card balances or payday loans. Securing a lower interest rate through consolidation can save money in the long run.

Multiple Debts

If you have multiple debts with varying due dates and minimum payments, managing them can be overwhelming. Debt consolidation simplifies this by consolidating all your debts into a single monthly payment.

Improved Financial Discipline

Debt consolidation can help individuals commit to getting their finances back on track. It requires discipline to make consistent monthly payments and avoid accumulating new debt.

Stable Income

Before pursuing debt consolidation, ensure you have a stable source of income to cover the monthly payments. This will prevent you from falling into further financial trouble.

Realistic Repayment Plan

Evaluate whether you can afford the new consolidated loan. Be sure to factor in your monthly living expenses and other financial obligations.

Credit Score

Debt consolidation may impact your credit score. While it can help by reducing your overall debt-to-credit ratio, opening a new credit account may temporarily lower your score. However, consistent on-time payments can help rebuild your credit over time.

Seek Professional Advice

Consult a financial advisor or credit counselor to assess your situation. They can provide personalized guidance and recommend the best debt consolidation method.

Alternatives to Debt Consolidation Loan

Debt consolidation is not the only way to manage debt. There are many alternatives to debt consolidation loans. Here are a few of the most common:

Make a budget and stick to it

This is the most important thing you can do to manage your debt. A budget will help you track your income and expenses to see where your money goes. Once you know where your money is going, you can make changes to free up more money to pay off your debt.

Negotiate with your creditors

If you are struggling to make your payments, you may be able to negotiate with your creditors to lower your interest rates or monthly payments. This can make it easier to stay on top of your debt.

Use a balance transfer credit card

A balance transfer credit card allows you to transfer your existing debt to a new card with a lower interest rate. This can save you money on interest in the long run.

Use a debt management plan

A debt management plan is a program that helps you consolidate your debt and make one monthly payment to a credit counseling agency. The agency will negotiate with creditors to lower your interest rates and monthly payments.

File for bankruptcy

Bankruptcy is a legal process that can help you eliminate your debt. However, it should be considered as a last resort, as it can hurt your credit score.

Debt Snowball or Avalanche

These methods involve paying off debts individually, starting with the smallest balance (snowball) or the highest interest rate (avalanche).

The best alternative for you will depend on your individual circumstances. If you struggle to manage your debt, speaking with a financial advisor for personalized advice is important.

Here are some additional things to consider when choosing an alternative to debt consolidation:

Your current financial situation: Can you afford to make the monthly payments on the alternative?

Your credit score: A good credit score will make it easier to qualify for some alternatives, such as a balance transfer credit card or a debt management plan.

Your goals: What are your goals for managing your debt? Are you looking to lower your monthly payments, improve your credit score, or both?

It is important to carefully weigh each alternative’s pros and cons before deciding.

Conclusion

A debt consolidation loan is a promising path to financial relief in the complex personal finance landscape. It allows individuals to streamline their debts into a single, more manageable payment, potentially reducing the financial strain caused by high interest rates and multiple due dates. However, as with any financial decision, weighing the pros and cons, assessing your unique circumstances, and consulting with financial professionals when necessary is crucial.

A debt consolidation loan can be a lifeline for those drowning in a sea of debt, but its success depends on disciplined financial management. It is not a magic wand that erases debts overnight but a tool to regain control and pave the way towards financial stability.

Remember that successful debt consolidation often involves a commitment to responsible spending, budgeting, and diligent repayment. It’s a journey that requires dedication and patience, but the rewards—reduced financial stress, improved credit, and a brighter financial future—are well worth the effort.

So, if you find yourself navigating the challenges of multiple debts, consider the potential benefits of a debt consolidation loan. Seek guidance, create a realistic repayment plan, and take the first step towards a more secure financial future. With determination and the right strategy, financial relief is within reach.