In the dynamic world of personal finance, AXIO Personal Loan emerges as a key to unlocking financial freedom. As we navigate the twists and turns of life, there often arises a need for extra funds – be it for a dream project, unexpected expenses, or simply to seize an opportunity. AXIO steps in as your trusted companion, offering not just financial assistance, but a pathway to a hassle-free and empowered borrowing experience.

Whether it’s for a home renovation, education expenses, or unexpected medical bills, a reliable personal loan can be a financial lifesaver. Axio Personal Loan stands out as a promising option for those seeking a trustworthy lending partner.

Let’s delve into the details of why AXIO is more than just a loan – it’s a financial ally on your journey to achieving your aspirations.

What is Axio Personal Loan?

Axio Personal Loan is a financial product offered by Axio Bank, designed to cater to the diverse needs of individuals. This loan is tailored to provide borrowers with the flexibility and convenience they require while ensuring a transparent and hassle-free borrowing experience.

Features and Benefits of Axio Personal Loan

1. Competitive Interest Rates

Axio loan prides itself on offering competitive interest rates. This means borrowers can access the funds they need without the burden of exorbitant interest charges, allowing for a more manageable repayment journey.

2. Flexible Loan Amounts

Understanding that financial needs vary, Axio provides a range of loan amounts to accommodate different requirements. This flexibility ensures that borrowers can secure the precise amount they need, avoiding the burden of borrowing more than necessary.

3. Quick and Easy Approval Process

In a world where time is of the essence, Axio Loan stands out for its quick and easy approval process. The online application system streamlines the entire process, allowing borrowers to receive approval swiftly, sometimes within a matter of hours.

4. No Hidden Fees

Axio believes in transparency. With Axio Loan, borrowers can rest assured that no hidden fees are lurking in the terms and conditions. Clear and straightforward, the loan agreement ensures borrowers understand the costs involved from the outset.

5. Customizable Repayment Plans

Recognizing that one size does not fit all, Axio offers customizable repayment plans. Borrowers can work with the bank to tailor a repayment schedule that aligns with their financial capabilities, reducing the stress associated with rigid payment structures.

Also, Read – Over 100 Websites Blocked, “Ghar Baithe Job” & Task-Based Job Offer Scam Exposed

Eligibility Criteria for Axio Personal Loan

Axio has designed its eligibility criteria to be inclusive, allowing a broader range of individuals to qualify for personal loans. While specific requirements may vary, the general criteria include a stable income, a good credit score, and a clean financial history.

How to Apply for Axio Personal Loan

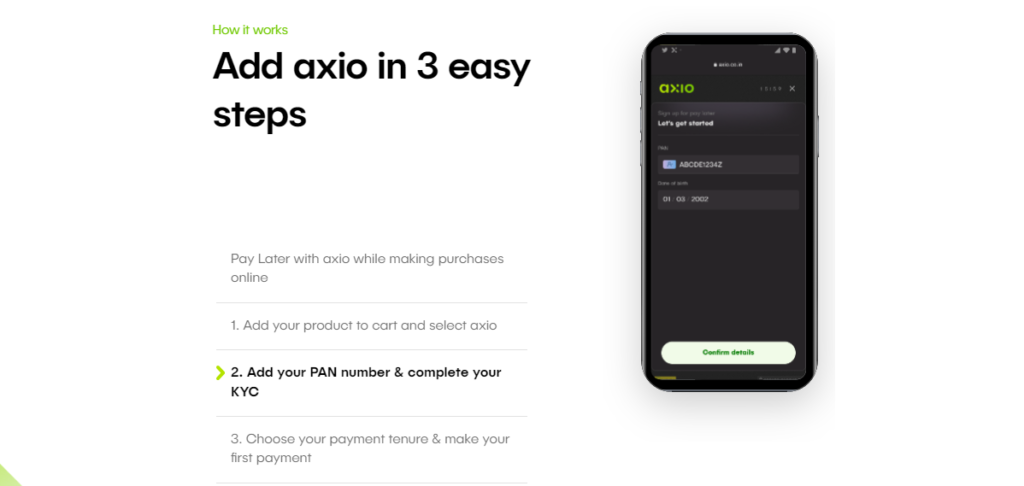

Applying for an Axio Loan is a straightforward process that can be completed online. The user-friendly interface guides applicants through each step, collecting necessary information and documents efficiently. The digital platform ensures a secure and seamless application experience.

Interest Rates and Fees of Axio Personal Loan

Understanding the financial implications of a personal loan is crucial. Axio Loan provides clarity on interest rates and fees from the beginning. The interest rates are competitive, and any applicable fees are disclosed upfront, allowing borrowers to make informed decisions.

Loan Repayment and Tenure

Axio understands that borrowers have different financial capacities and preferences. Hence, they offer various repayment tenures to suit individual needs. Whether one prefers a shorter tenure with higher monthly payments or an extended period with lower installments, Axio Personal Loan provides the flexibility needed.

Benefits of Choosing Axio Personal Loan

1. Customer-Centric Approach

Axio Bank places a strong emphasis on customer satisfaction. The bank’s customer service team is dedicated to addressing queries promptly, ensuring that borrowers feel supported throughout their loan journey.

2. Online Account Management

Axio’s online platform allows borrowers to manage their loan accounts effortlessly. From checking the outstanding balance to making payments, the intuitive interface enhances user experience, making financial management more convenient.

3. Additional Financial Resources

Beyond personal loans, Axio Bank offers a range of financial products and resources. This holistic approach ensures that customers have access to a suite of services, allowing them to address various financial needs under one roof.

Axio Personal Loan vs Traditional Personal Loans

1. Speed and Convenience

Traditional personal loans often involve lengthy paperwork and approval processes. Axio’s digital platform accelerates the loan application and approval process, providing borrowers with a quicker and more convenient experience.

2. Transparent Terms

Axio’s commitment to transparency sets it apart from some traditional lenders who may have hidden fees or unclear terms. Axio Personal Loan ensures borrowers understand the terms and conditions, fostering trust and confidence in the lending relationship.

3. Customization Options

While traditional lenders may offer fixed repayment plans, Axio Personal Loan provides customization options. This flexibility allows borrowers to tailor the loan to their specific financial situation, offering a more personalized borrowing experience.

Conclusion

In the realm of personal finance, Axio Personal Loan stands as a reliable and customer-focused solution. From competitive interest rates to flexible repayment options, Axio ensures borrowers can confidently navigate their financial journey. The transparency, efficiency, and additional benefits make Axio a formidable player in the personal loan landscape, catering to the diverse needs of individuals in 2024.