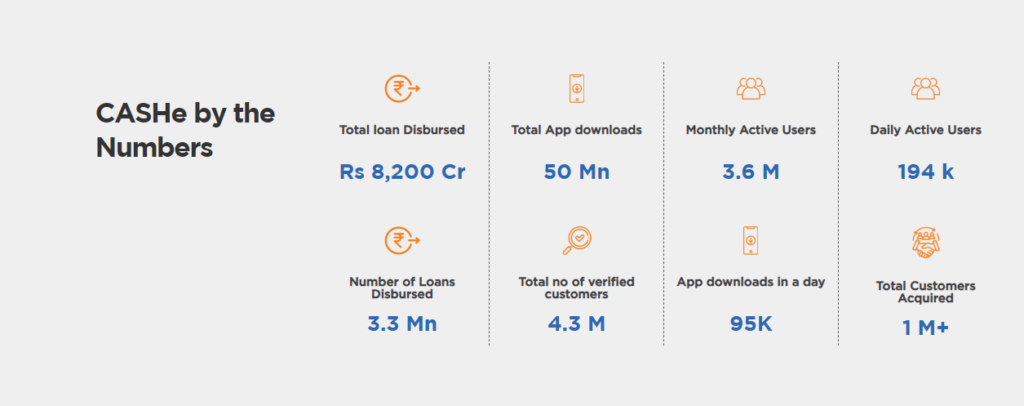

In the digital age, financial assistance is just a few taps away, and CASHe Personal Loan App is a prominent player in this landscape. Offering the fastest personal loan or instant personal loan to salaried individuals in India, CASHe has gained popularity for its accessible lending platform. In this review, we will delve into the details of the CASHe Personal Loan App review, covering everything from loan amounts to the application process and even addressing concerns about its legitimacy.

Disclaimer:

This article is for informational purposes only and should not be construed as financial advice. The information contained in this article is based on the author’s own research and experience and may not apply to all borrowers. It is important to consult with a financial advisor before deciding on a personal loan.

CASHe Personal Loan Review – Amount and Tenure

CASHe provides a flexible loan range, making it suitable for various financial needs. You can borrow anywhere from INR 1,000 to INR 4 lakh. What’s particularly accommodating is the choice of repayment tenure, which spans from 15 days to 6 months. This flexibility ensures that borrowers can tailor their loans to their specific requirements.

Here are some factors that affect the Fibe Personal Loan amount and tenure:

- Monthly Income: To be eligible for a CASHe loan, you need a minimum monthly income of INR 12,000. Higher incomes may grant access to larger loan amounts.

- Creditworthiness: Your credit score and repayment history will influence the interest rate and the maximum loan amount you can secure. A strong credit profile can lead to more favorable terms.

Key Features of the CASHe Personal Loan App

CASHe stands out with its user-friendly mobile app, available on both Android and iOS. Let us move forward with CASHe Personal Loan review and read the detailed features.

- Quick Application: Applying for a CASHe personal loan is a breeze. The app streamlines the process, allowing you to complete your application in minutes.

- Instant Disbursal: Once approved, funds are swiftly credited to your bank account, ensuring you can address your financial needs promptly.

- Competitive Interest Rates: The interest rate you receive is tied to your creditworthiness, offering a personalized experience.

- Flexible Repayment Terms: With various tenure options, CASHe accommodates diverse financial circumstances.

- Security: CASHe is a registered entity with the Reserve Bank of India (RBI), reassuring borrowers of its legitimacy and compliance with regulatory standards.

Pros and Cons of CASHe Personal Loan App

The CASHe Personal Loan App offers several advantages, such as quick loan approval and disbursement, making it a convenient choice for those needing immediate funds. Additionally, it doesn’t require collateral, making it accessible to a broader range of individuals. In this CASHe Personal Loan Review, we will understand the pros and cons in detail so that you make the best decision for taking a personal loan.

However, it’s essential to consider the interest rates, which can be relatively high, and ensure that you can comfortably manage the repayments. Like any financial service, CASHe has its pros and cons, so evaluating your financial situation and needs is crucial before opting for this personal loan app.

Pros:

- Quick and easy application process.

- Instant loan disbursal.

- Competitive interest rates.

- Flexible repayment terms.

- Secure and reliable platform.

- Availability in multiple languages, including Hindi, English, and Tamil.

Cons:

- Loan approval and interest rates may vary based on individual credit profiles.

- High-interest rates and processing fees.

- It primarily caters to salaried individuals, excluding self-employed individuals.

- The app and its UI are not up to the mark

- Custom Support is feeble.

Documents Required for CASHe Personal Loan App

When applying for a personal loan through the CASHe app, you must provide certain documents to complete the process smoothly. Here’s a list of the essential documents required:

- Aadhar Card: A valid Aadhar card is essential for identity verification. It serves as proof of your identity and residency.

- PAN Card: Your Permanent Account Number (PAN) card is necessary for financial transactions and income verification. It helps CASHe assess your eligibility for the loan.

- Bank Statements: Providing your bank statements for the past few months demonstrates your financial history and income stability. It helps CASHe evaluate your ability to repay the loan.

- Salary Slips: Submitting your recent salary slips is crucial if you’re salaried. These documents confirm your employment and income details. You don’t need to submit salary slips, they will do it through a third party online verification app.

- Proof of Address: To establish your residential address, you can provide documents such as a utility bill, passport, or driver’s license. Make sure the address matches the one you’ve registered with CASHe.

- Employment Proof: If you are self-employed or a business owner, you may need to provide business registration documents, income tax returns, or other business-related documents to prove your income and employment status.

- Online Selfie or Video KYC: An online selfie or video KYC is required for identity verification and loan documentation.

- References: In some cases, CASHe may ask for personal or professional references to verify your background and character.

It’s important to ensure that all your documents are accurate and up-to-date. Having these documents ready and readily accessible will expedite the loan application process through the CASHe Personal Loan App, making securing the funds you need more convenient.

Also, Read – Debt Consolidation Loan: A Path to Financial Relief

Who Should Apply for a CASHe Personal Loan?

A CASHe Personal Loan can be a suitable financial option for individuals facing specific financial situations. Ensure you thoroughly read their terms and conditions, interest rates, and processing fees. Here’s a straightforward guide to help you determine if applying for a CASHe Personal Loan is the right choice for you:

1. Salaried Individuals

If you’re a salaried employee needing quick access to funds for emergencies, planned expenses, or debt consolidation, a CASHe Personal Loan can be a viable solution. The straightforward application process and fast approval times make it convenient for those with a stable income source.

2. Self-Employed Professionals

Individuals, like freelancers, consultants, or entrepreneurs, can also consider CASHe Personal Loans to meet their financial needs. It allows them to manage their business expenses, cash flow fluctuations, or personal financial requirements.

3. Students

College students or young adults pursuing higher education often require financial support for tuition fees, books, or living expenses. A CASHe Personal Loan can be an option for students with a part-time job or a source of income to repay the loan.

4. Individuals with a Good Credit History

You may qualify for favorable terms and interest rates on a CASHe Personal Loan if you have a positive credit history and a responsible track record of repayment. Your creditworthiness can make this option more cost-effective than other borrowing forms.

5. Emergency Situations

CASHe Personal Loans can be especially beneficial during unexpected emergencies, such as medical bills, car repairs, or urgent travel expenses. The quick approval process ensures you can promptly address these unforeseen financial challenges.

6. Those Seeking Convenience

If you value a hassle-free and convenient loan application process that can be completed online via the CASHe app, this option may suit your preferences. CASHe’s user-friendly interface and fast disbursement can save you time and effort.

7. Short-Term Financial Needs

CASHe Personal Loans are typically short-term loans, making them suitable for individuals who need funds for a specific purpose and can repay the loan within a few months.

CASHe Personal Loans can be a valuable financial resource for various individuals. However, assessing your specific needs, financial capacity, and willingness to repay is essential before applying. As with any form of borrowing, responsible financial management is key to making the most of a CASHe Personal Loan while avoiding unnecessary debt.

CASHe Personal Loan: Real or Fake?

CASHe is a legitimate financial technology (FinTech) company offering personal loans to eligible individuals in India. It operates under the regulations and guidelines of the Reserve Bank of India (RBI) and follows the necessary legal and compliance procedures.

Here are some key points that validate the authenticity of CASHe:

1. RBI Registration

CASHe is a registered non-banking financial company (NBFC) with the RBI, India’s central banking institution. This registration clearly indicates its legitimacy and compliance with financial regulations.

2. User Reviews

Many user reviews and ratings on various app stores and online platforms corroborate CASHe’s authenticity. Users share their positive and negative experiences, which can provide insights into the app’s performance.

3. Website and Contact Information

CASHe maintains an official website with detailed information about its services, terms, and conditions. Legitimate contact information, including a customer support helpline and email address, is readily available for users to contact for assistance.

4. Loan Disbursement

CASHe disburses loans directly to users’ bank accounts upon approval. The funds are deposited securely and can be verified through users’ bank statements.

5. Privacy and Security

CASHe emphasizes user data privacy and employs robust security measures to protect personal and financial information. This commitment to security is a hallmark of a legitimate financial institution.

6. Transparent Terms

CASHe provides clear and transparent loan terms, including interest rates, repayment schedules, and associated fees. Users can review these terms before applying for a loan.

7. Regulatory Compliance

As a registered NBFC, CASHe adheres to regulatory guidelines, ensuring its lending practices are within the legal framework.

8. Customer Support

CASHe offers customer support to promptly address user inquiries, concerns, and issues. This level of customer service aligns with legitimate financial institutions’ practices.

Beware of Scams

While the CASHe Personal Loan App is a legitimate platform, it’s essential to exercise caution and be aware of potential scams in the digital financial space. Scammers may create fake apps or websites that mimic legitimate services to deceive users and steal their personal and financial information.

To avoid falling victim to scams:

- Download the CASHe app only from official app stores (Google Play Store or Apple App Store).

- Verify the app’s legitimacy by checking for user reviews, ratings, and contact information.

- Ensure that you understand the terms and conditions of any loan before proceeding.

- Be cautious of unsolicited communication and requests for sensitive information.

CASHe Personal Loan App is a genuine and legitimate platform for obtaining personal loans in India. However, staying vigilant and practicing online safety is crucial to protect yourself from scams or fraudulent activities in the digital financial landscape. Always verify the authenticity of any financial service you choose to use.

CASHe Personal Loan Review – Application Process

The CASHe Personal Loan application process is swift and hassle-free. Download the app, provide your information, upload the necessary documents, and submit your request. Once approved, your funds are promptly disbursed to your bank account.

- Download the CASHe app from the Google Play or Apple App Store.

- Create an account and provide your personal details.

- Upload your documents, such as your PAN card, Aadhaar card, and bank statement.

- Select the desired loan amount and repayment tenure.

- Submit your application.

The streamlined process ensures that borrowers can access funds quickly and efficiently.

My Personal Experience with CASHe Personal Loan

Over the past year, my journey with the CASHe Personal Loan App has been a mixed bag. On one hand, the app proved to be a lifesaver in times of financial need, offering quick loan approval and a user-friendly experience. With the app readily accessible on my smartphone, I could easily handle emergencies and planned expenses. However, the downside came in the form of high interest rates and processing fees, which added to the overall cost of borrowing.

What stood out as a significant drawback in my experience was CASHe’s approach to missed due dates. The app has a robust system in place to track and remind users of their payment obligations, which, while understandable from a lender’s perspective, could become quite persistent and even intrusive. Calls from third-party collectors and messages on WhatsApp became a constant reminder of the repercussions of a missed due date, making me wish for a more empathetic approach to handling such situations. In conclusion, CASHe offers convenience in obtaining personal loans but comes with its fair share of financial implications and persistent reminders in the event of late payments.

Here are some details regarding my experience with Fibe Personal Loan:

- Loan Amount: I applied for a loan of ₹50000

- Application Process: The application process was impressively quick and easy.

- Fund Disbursement: They take 1 or half days to disburse the amount to your account.

- Interest Rate: My loan’s interest rate was 18 to 21% annually.

- Repayment Term: I opted for a 9-month repayment term, which allowed me to manage my monthly repayments comfortably.

- Customer Service: Worst customer service I have experienced in my life. No customer care number, only reply through mail.

SCAM-FREE CASHe Personal Loan Review Rating

Conclusion

CASHe Personal Loan App is a reliable and legitimate platform for salaried individuals seeking short-term financial assistance in India. It offers a convenient solution for various financial needs with competitive interest rates, flexible repayment terms, and a user-friendly interface. However, borrowers should always assess their own financial situation and compare loan terms before making a final decision. By following the provided guidelines, you can confidently explore the benefits of CASHe’s lending services.

FAQs

Is CASHe personal loan safe?

CASHe Personal Loan is a legitimate financial technology (FinTech) service that operates under the regulations and guidelines set by the Reserve Bank of India (RBI). As such, it can be considered safe to use within the parameters of responsible financial management.

Is CASHe under RBI?

CASHe is not classified as a bank or a non-banking financial company (NBFC) itself; instead, it operates in partnership with Bhanix Finance and Investment Ltd., an RBI-registered NBFC.

What is the tenure of CASHe EMI?

The tenure of CASHe EMI, or Equated Monthly Installments, typically varies based on the specific loan terms and conditions CASHe offers. Depending on your loan amount and repayment capacity, it can range from a few months to a maximum of 12 months. It’s essential to review the loan terms and choose a tenure that aligns with your financial situation and ability to make timely repayments.