When it comes to getting a personal loan, knowing your options is key. Let’s focus on one option today: Moneyview loans. In this thorough review, we’ll talk about what makes Moneyview loans a good choice, what might not be so great, and the actual benefits you get. By the end, you’ll have a clear picture to help you make smart decisions about your money.

We’ll delve into the advantages, drawbacks, and real benefits these loans bring to borrowers. By the end, you’ll have the insights to make an informed financial choice.

Disclaimer: Borrow Wisely, Borrow Responsibly

Before you embark on any financial venture, remember that borrowing entails a commitment. Your financial well-being should always be your priority. Any Loan taken from the App or web requires thoughtful and prudent use.

Remember, this review is based on a balanced evaluation of the app’s features and potential drawbacks. Your unique financial circumstances will determine whether KreditBee aligns with your needs. Always take the time to explore, compare, and make a decision that serves your long-term financial interests.

Note: For all the loan apps that we are reviewing, we have personally used that app for a long tenure or got an honest review from someone who is using these apps to give you an honest review.

What is the Moneyview Loan App?

Moneyview, a prominent financial technology company in India, offers a range of personal loans to cater to diverse financial needs. Let’s dive into an unbiased review of Moneyview loans, outlining their advantages, drawbacks, and the benefits they bring to borrowers.

Moneyview Loan Amount and Tenure

Moneyview, a leading financial technology company, offers various loan amounts and tenures to suit varying financial requirements. Whether you’re looking for a small amount to cover immediate expenses or a larger sum for a major investment, Moneyview has you covered. With flexible repayment options, you can choose a tenure that aligns with your financial goals. The company offers loans ranging from Rs. 5,000 to Rs. 10 lakhs, with 3 to 60 months of tenure. The interest rates on Moneyview loans start at 1.33% per month, and the processing fees vary from 2% to 5% of the loan amount.

Moneyview Loan – Documents Required

When applying for a Moneyview loan, the process is streamlined and digital. You’ll need to provide a few essential documents to ensure a smooth application:

PAN Card: Your Permanent Account Number (PAN) card is a crucial identification document for the loan application process.

Aadhaar Card: Your Aadhaar card, which serves as proof of identity and address, is required for verification.

Latest Salary Slip or Bank Statement: To assess your repayment capacity, Moneyview may ask for your latest salary slip or bank statement.

Online Selfie or Photograph: A recent photograph of yourself is needed for identification.

Once you’ve gathered these documents, you can initiate the loan application process through Moneyview’s website or app.

Moneyview Loan Benefits

Opting for a Moneyview loan has several advantages:

Competitive Interest Rates: Moneyview offers loans with competitive interest rates, starting at 1.33% monthly. This can save you money compared to higher rates from traditional sources.

Quick Application and Approval: The entire application process is digital, and Moneyview reviews your eligibility within 24 hours. Once approved, the loan amount is disbursed to your bank account within the same timeframe.

Direct Disbursement: Once approved, the loan amount is directly transferred to your bank account, ensuring swift access to funds.

User-Friendly App: Moneyview provides a user-friendly app that allows you to seamlessly track your loan status, make payments, and manage your borrowing experience.

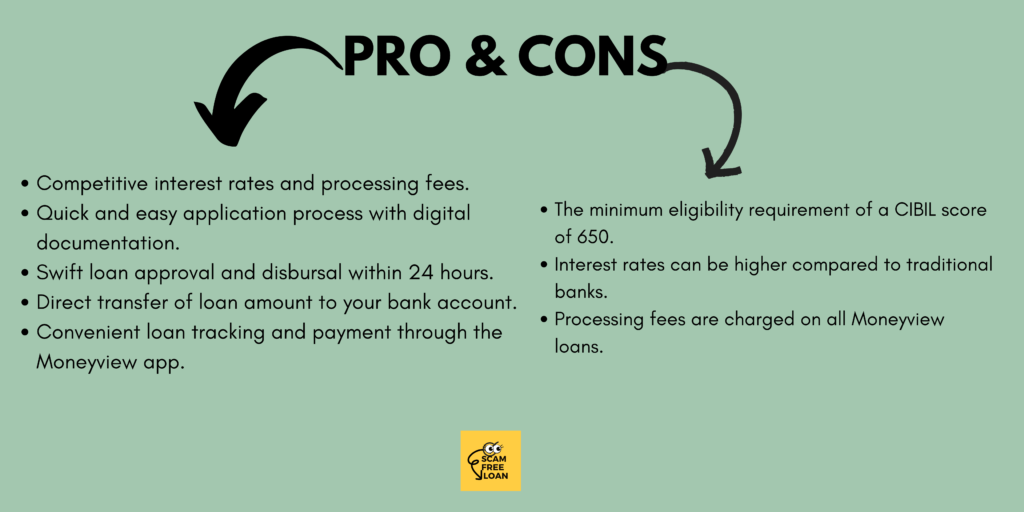

Moneyview Loan – Pros and Cons

Every loan application or bank loan comes with its own advantages and disadvantages. Money comes with exceptional pros and little cons.

Pros

- Competitive interest rates and processing fees.

- Quick and easy application process with digital documentation.

- Swift loan approval and disbursal within 24 hours.

- Direct transfer of loan amount to your bank account.

- Convenient loan tracking and payment through the Moneyview app.

Cons

- The minimum eligibility requirement of a CIBIL score of 650.

- Interest rates can be higher compared to traditional banks.

- Processing fees are charged on all Moneyview loans.

Money View raises $75 Mn in Series E at $900 Mn valuation

Money View, an online platform that offers credit services, has recently received a boost of $75 million in its ongoing Series E funding round. This investment is primarily led by Apis Partners, a company based in the UK that manages assets. Other contributors to this round include Tiger Global, Winter Capital, and Evolvence.

This new funding has increased Money View’s overall value to $900 million. Just a few months back in March, during a funding round led by Tiger Global, the company was valued at $625 million. There were discussions about raising approximately $150 million at a valuation that qualifies it as a unicorn company.

Who Should Apply for a Moneyview Loan?

Moneyview loans benefit individuals:

- Needing funds for medical expenses, weddings, or home renovations.

- Looking to improve their credit score through responsible repayment.

- Seeking flexible repayment tenure options that suit their budget.

Moneyview Loan Application Process

Online Application: Apply for a Moneyview loan through their website or mobile app.

Document Submission: Upload the required documents, including a PAN card, Aadhaar card, salary slip/bank statement, and a recent photograph.

Eligibility Review: Moneyview reviews your eligibility within 24 hours based on the provided documents.

Loan Approval: The loan amount will be credited to your bank account within 24 hours.

Is Moneyview a Safe Loan App?

Yes, Moneyview is a trusted financial technology company. However, as with any financial transaction, it’s essential to ensure you’re using the official Moneyview app or website to protect your personal and financial information.

Remember, before committing to any financial decision, it’s wise to carefully evaluate your needs, understand the terms and conditions, and compare options to make the best choice for your financial well-being.

Scam Free Loan Ratings

Conclusion

Moneyview loans present a convenient and efficient way to secure personal funding. Their competitive rates, swift approval process, and user-friendly app are commendable. However, weighing these advantages against the eligibility criteria, higher interest rates, and processing fees is important.

Before committing to a Moneyview loan, carefully review the terms, understand the costs involved, and assess your ability to meet the monthly payments. Borrowers should also consider comparing Moneyview’s offerings with those of other lenders to make an informed decision.

If you’re considering a Moneyview loan, consulting a financial advisor can provide personalized guidance tailored to your situation.

Remember, informed decisions lead to better financial outcomes.

For further information, please don’t hesitate to contact us. Your financial aspirations matter, and we’re here to guide you every step of the way. If you have any specific questions related to these loan apps, you can always reach out to us at scamfreeloan@gmail.com.